A wide body of academic research suggests that bringing project delivery in-house results in more cost-effective transit capital projects. But how does this play out on a project-level? In this blog post we investigate how overreliance on consultants, coupled with lack of oversight, is inflating costs and reducing scope and ambition to an alarming degree on Coachella Valley Rail.

We find that:

- CV rail service planning and preliminary design costs 3-10x more than comparable, consultant-led rail projects

- Construction is projected to start more than 20 years after first alternatives analysis

- RCTC has repeatedly contracted with the same consultant for questionably necessary services on this project

- Caltrans completes similar pre-construction activities in-house for thousands of road projects every year. Caltrans should take over “bread and butter” rail projects like CV rail to improve project costs and outcomes.

Case Study: Coachella Valley Rail

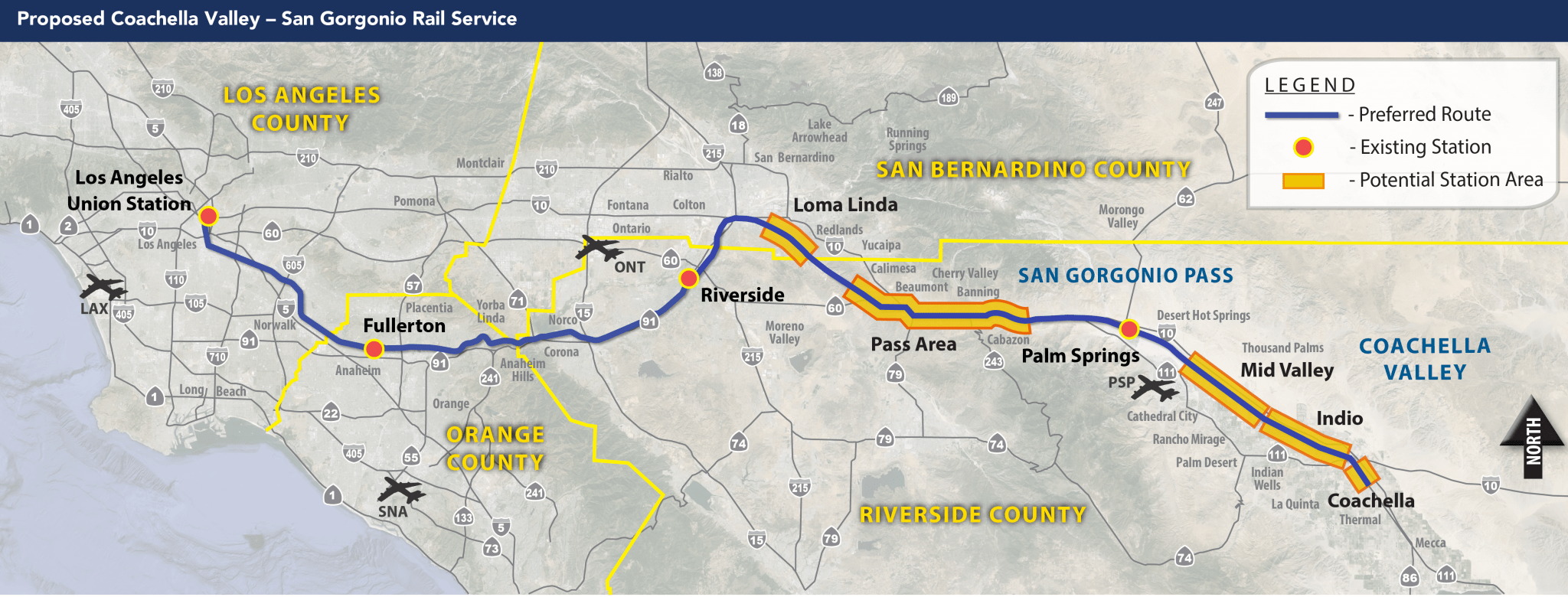

Coachella Valley Rail, under the Riverside Transportation Commission (RCTC) proposes two round trips between Indio, Palm Springs and Los Angeles Union Station, with new stops serving job centers and rapidly-growing suburbs in Riverside and San Bernardino Counties. CV Rail would improve existing active freight corridors to allow additional service on a line that currently sees 3 long-distance trains per week.

RCTC is a Joint Powers Association that funds and manages Metrolink regional rail service in Riverside County. They have had a consistent focus on expanding conventional regional rail on existing right of way. They launched the 91/Perris Valley Line in 2002, opened the extension to Perris in 2016, and since 2016 have been actively double-tracking the extension. All of these projects primarily consisted of track rehabilitation, multi-tracking, and new stations on existing freight right of way - much like the CV Rail project. All of these projects would fit nicely into an Italian-style rolling modernization project, where a consistent incremental capital program enables standardization, accumulation of knowledge, and lower costs over time.

Instead, RCTC has chosen to rely on consultants to deliver these projects.

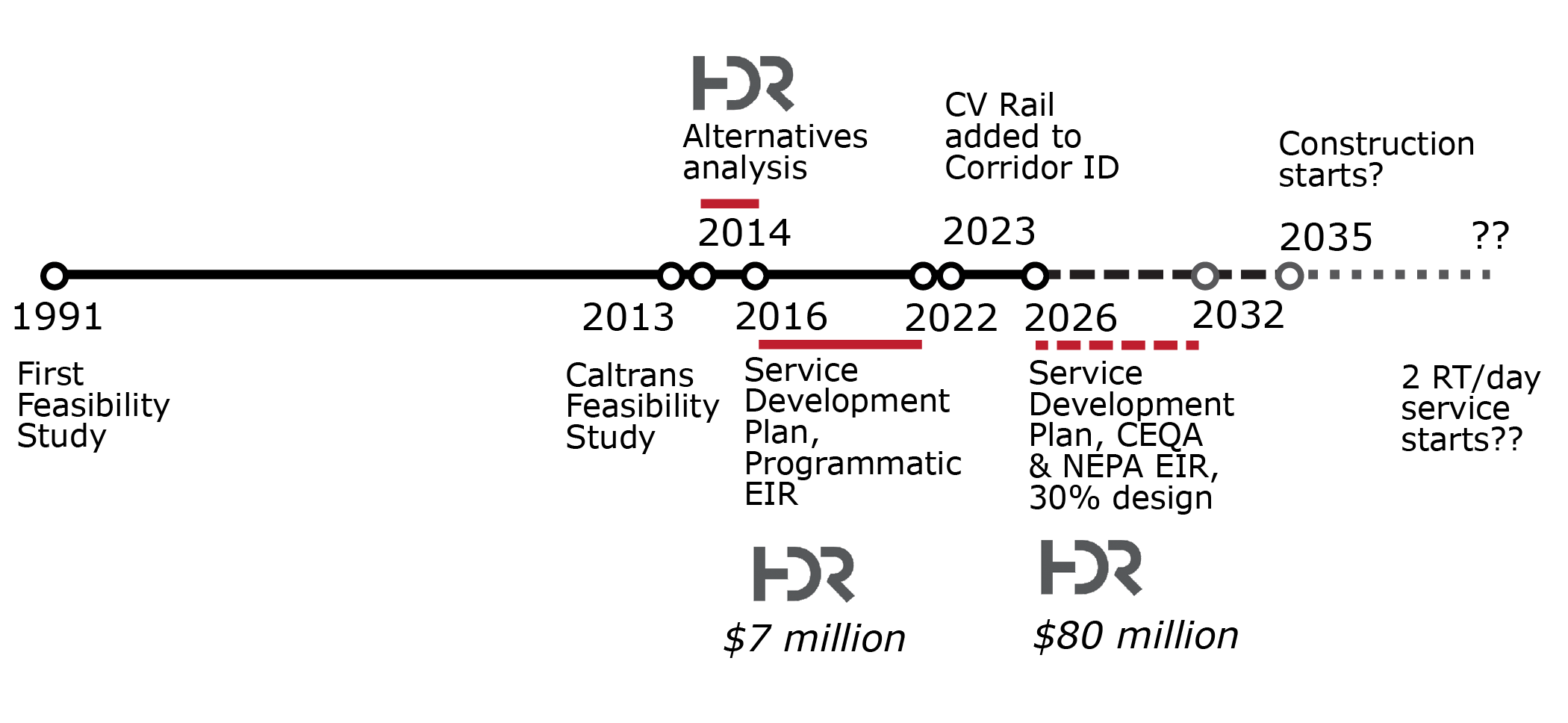

Coachella Valley Rail’s original feasibility studies proposed this service in 1991 and a subsequent Caltrans feasibility was delivered in 2013. Next in 2014 RCTC hired consultant HDR to perform an alternatives analysis and conduct a programmatic environmental review. This alternatives analysis was delivered in 2016.

HDR worked on a service development plan from 2016-2022. A Service Development Plan provides a standardized way that funders can evaluate ridership, travel time savings, required operational subsidies or potential profits, as well as conceptual infrastructure plans and costs. Service Development Plans are part of service-led planning and a general good practice to optimize investment.

From 2016-2022, HDR also worked on a programmatic EIR/EIS, which was was approved by RCTC in 2022. A programmatic EIR/EIS is typically used for very large infrastructure projects like California High-Speed Rail’s Phase 1 network development to study large cumulative changes or impacts on growth or land use. It is infrequently or rarely used for discrete infrastructure projects. During this phase HDR billed over $7m to RCTC for this work.

Under the programmatic EIR/EIS the build alternative consists of “[p]otential new infrastructure improvements on the Eastern Section could include sidings, additional mainline track, wayside signals, drainage, grade separation structures, and stations to accommodate the proposed service” - similar elements to those already delivered for RCTC for the Perris Valley Line.

In 2023 FRA accepted Coachella Valley Rail into Corridor ID and provided funding to update its service development plan to reflect changes to the Corridor ID program as a result of the Bipartisan Infrastructure Law.

In August 2025 RCTC directed staff to procure services necessary for an updated service development plan, including CEQA document, preliminary engineering, station studies, NEPA document, and 30% designs. Staff penciled in six years (April 2032) to complete these activities, which would not bring the project to final, ready for construction design. Staff issued a request for qualifications for a consultant to lead this process.

In January 2026 RCTC staff recommended, after qualifying two firms, awarding this service contract to… HDR, the same firm that has been performing planning, service development and environmental review services for twelve years for RCTC on Coachella Valley Rail. A proposed contract split into two phases was approved. The initial Service Development Plan phase, consisting of CEQA, station studies, pre-NEPA document and preliminary engineering is budgeted at $58m. The second phase of NEPA and 30% design is budgeted at $16m, although staff cautions this could be higher. RCTC awarded the recommended contract of $80m to HDR.

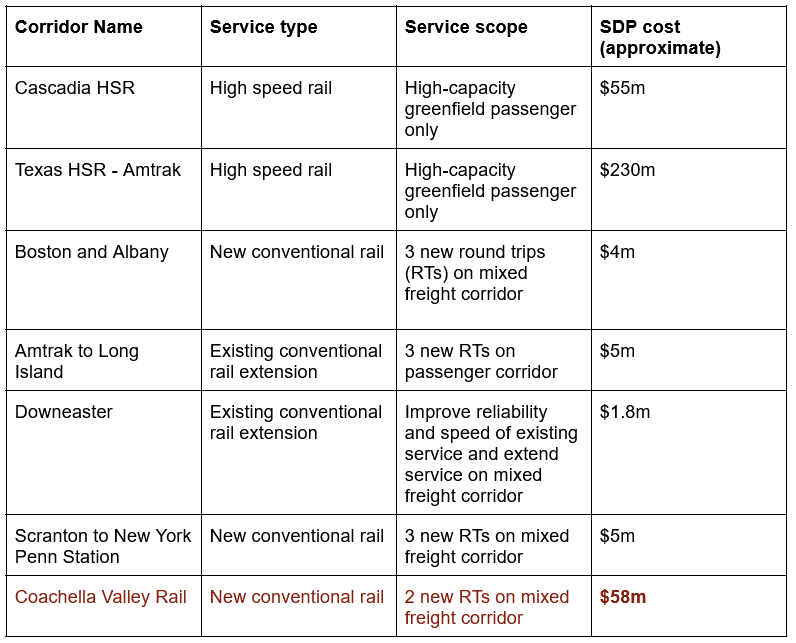

For context, here are some approximate Service Development Plan costs for other Corridor ID projects:

Note that it is not clear whether these other Service Development Plans include preliminary engineering or other costs included in the Coachella Valley Rail contract.

Analysis

$100m and six years for a relatively straightforward project producing 2 round trips to advance to 30% design should be a large red warning light for rail advocates in California. This means the best case scenario is that design would not be finalized until 2034 and construction would start in 2035. Over 20 years to deliver two round trips. This is not sustainable. Meanwhile, RCTC completed multiple major highway widenings along the Coachella Valley Rail corridor in 2017 and 2022, with several smaller expansions about to break ground as of 2026. Slow and costly rail project delivery is locking in car-oriented land use and high transportation costs and growing traffic and air pollution in the region for decades to come.

Operators of other intercity and regional railroads in California like Capitol Corridor, LOSSAN, Valley Rail and SMART have recently advanced consultant services contracts for similar straightforward projects for ¼ or ⅓ of the projected costs of Coachella Valley Rail. For example, Capitol Corridor’s 2019 consultant scope of environmental review and 30% design for South Bay Connect to upgrade UPRR’s Coast Line was $18m. While labor costs have gone up since COVID-19, it’s not clear that they have quadrupled. Based on costs for preliminary engineering for similar rail projects elsewhere in California and the Service Development Plan comparison chart above, it is unclear how RCTC arrived at the price for services for HDR on Coachella Valley Rail. RCTC’s contract practices appear to be suffering from lack of public oversight.

It is not just a RCTC problem. Individual operators or sponsors may not be the best positioned to hire for these services. By fracturing responsibility for these services to various entities, which lack the capacity, California misses out on scope and design consistency that drives a thick supplier market for construction. CV rail is one of five conventional rail projects in California that must follow the Corridor ID process - the opportunity for standardization is there. If every service development plan is a bespoke product created by each operator then California rail projects will continue to be charged a premium by a constrained bidders’ market.

Given that the Corridor ID process and service development plans appears to be a core function for intercity rail and possibly transit service planning in the future, we need to be considering better and more efficient ways to scope and procure these services. Does it make sense for each operator to procure their own service development plan consultant?

Asking the Question

Would it make more sense for the State of California to use its state capacity to in-source this work?

The research from Transit Costs Project, SPUR, Eno Transit Center, UC Berkeley School of Law, and Yale Law School is clear: in-house capacity is correlated with lower costs of infrastructure, fewer cost overruns, higher quality infrastructure and projects delivered on schedule.

Activities like service planning are core elements of what’s needed for California to implement the State Rail Plan and deliver high-quality transit within cities and regions.

Given that service planning activities for intercity rail projects cost about $5m for each corridor, these are costs that could be shared between corridors and in-sourced to Caltrans. Travel demand analysis, existing conditions analysis, alternatives analysis, infrastructure scoping, environmental review, preliminary engineering and 30% are all activities that Caltrans already does for the State Highway System and bridges.

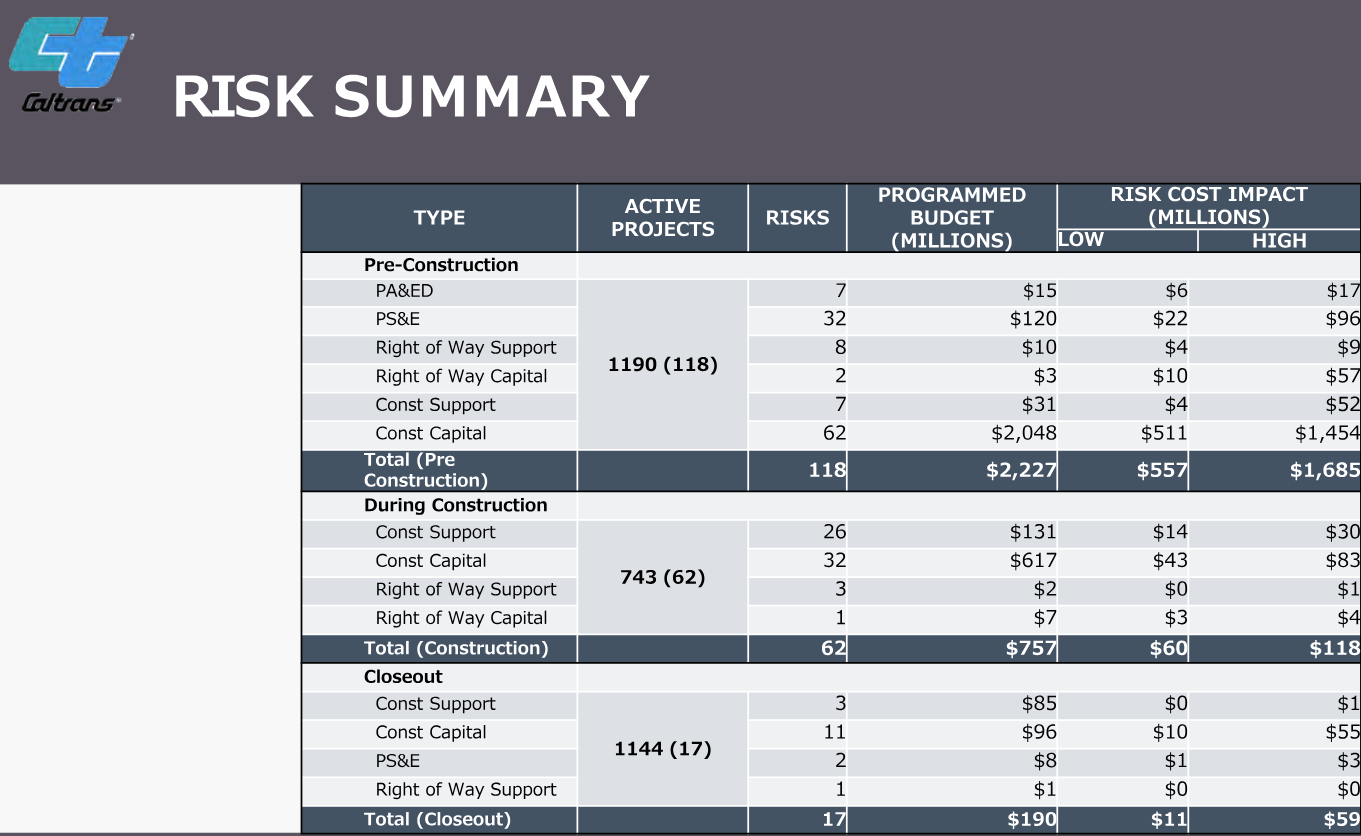

For road and bridge projects, Caltrans already shares project delivery costs across hundreds of discrete projects. These planning and project delivery costs are often reimbursed by Federal investment. For example, the chart below from Caltrans FY 2024-2025 Q1 Project Delivery Risk Review shows how preliminary design and environmental review (PA&ED), final design (PS&E) and other pre-construction support activities are shared across nearly 1200 discrete infrastructure projects.

Caltrans uses the scale of its project pipeline to share and distribute costs across projects. Based on these figures, each Caltrans project in pre-construction requires about $500k in support costs each year.

While in-sourcing service planning and pre-construction support for intercity rail and transit may not be able to achieve this level of efficiency, the animating principle is the same. Rather than have different operators or sponsors each procure their own planning and design services, these costs should be shared between rail corridors and regional transit networks.

For many intercity rail or passenger projects, the core infrastructure of embankments, bridges, overcrossings, platforms and signaling is well within Caltrans engineers' capability. While service planning may require new hires or re-organized roles, many of the engineering and support activities could be done by existing personnel.

To the extent Caltrans needs specialist consultants or there are spikes in demands for services, they could rely on a bench of on-call consultants. This is more efficient than each operator or sponsor hiring their own program management, service planning, environmental review, permitting, engineering, and design consultants separately.

Since the Federal government is already paying for these planning activities through Corridor ID there is a built-in funding source for Caltrans to recover costs.

Caltrans just took a small but important first step into supporting California transit through its Director’s Transit Policy. That policy focuses on supporting transit-supportive infrastructure on State Highway System facilities, better coordination with transit operators, and increased use of Caltrans Program Management services in support of transit. It stops short, however, of committing to using Caltrans planning and project delivery personnel to implement the State Rail Plan or local transit. Caltrans taking over the role of Service Development Plan management for intercity rail at first, but also regional rail, bus rapid transit and light rail is a clear path to make California transit golden.

0 Comments